An Advance Health Care Directive designates the people responsible for your health and may also state your health care wishes.

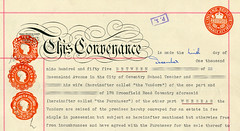

It must be a written properly executed legal document.

The health care agent designated by the Advance Health Care Directive has the power to make health care decisions on your behalf when you are unable to do so. You can designate a single agent or co-agents. When designating a single agent, you should also name an alternate agent or two if possible. Spouses each sign their own Advance Health Care Directive, so they are able to make different choices of alternate agents if they wish.

The powers of the agent are specified by the document or by law. Such powers include authorizing medical procedures, making living arrangements, including long term care, and making end-of-life decisions, such as withdrawing life support. The agent also has authority over disposition of remains after death, including choosing between burial or cremation.

The choice of the agent should take into consideration several factors: trustworthiness, understanding of your wishes and values, availability, ability to make stressful decisions, and skills in communicating with other family members. But remember that there is no perfect choice. Choose who you feel most comfortable with among the available family members or close friends.

The Advance Health Care Directive can also state your wishes for health care treatment and life support. These statements can include circumstances under which you want life support terminated, a do-not-resuscitate statement, wishes regarding living arrangements and any other wish you may have regarding your treatment when you are incapacitated.

Statutory forms of Advance Health Care Directives that can be filled in and signed by the maker without the need of an attorney are available from most hospitals. Attorneys can prepare more customized versions.

To be effective, the document needs to be signed and authenticated in two ways. Either your signature needs to be notarized or it needs to be witnessed by two individuals, one of whom cannot be a family member.

The Advance Health Care Directive can be amended or revoked in writing any time, as long as you are legally competent. It can also be revoked or modified orally when you are in the hospital by informing a nurse that you want to do so. The nurse is then required to record the change on your medical chart.

All competent adults, regardless of their financial circumstances, should have an Advance Health Care Directive.

LinkedIn

LinkedIn Twitter

Twitter RSS

RSS GooglePlus

GooglePlus